The ICC 2015 Trade Survey reported that 34.4% of

respondents encountered an increase in refusal rates of documents on first

presentation.

In the previous survey, 31% of respondents reported

an increase in the number of spurious discrepancies raised by issuing banks.

It is likely that, in most cases, this was due to

stricter document examination processes being implemented. However, an

indeterminate number of these discrepancies will have resulted from UCP

articles or sub-articles being specifically excluded by the terms and

conditions of a letter of credit, and what the issuing bank inserted as a new

or modified rule was ambiguous in its wording.

The prime aims of

UCP 600 were to:

-

Provide more transparency and clarity whilst

removing ambiguity;

-

Provide clearer understanding of the principles

of UCP;

-

Reduce misunderstanding.

Few would argue

that this has been achieved which would appear to indicate that UCP 600 may

have been a victim of its own success due to the fact that:

-

Most of the issues that are being raised with excluded

articles or sub-articles would have been no different with a transaction

subject to UCP 500.

-

Leading to a conclusion that UCP 500 was perhaps

not fully understood!

ICC Official Opinion R634 (TA638rev) provides a

number of important conclusions:

-

It

should be noted that a number of exclusions that are being made in credits are

provisions that essentially existed in UCP 500.

-

Banks

should keep any exclusions (if at all needed) to a minimum recognising

that it is often not as simple as merely making a statement in the

credit that article X or sub-article Y is deleted or is not to apply.

-

Very

often there is a need for a new condition to be inserted into the credit to

cover the void that the exclusion leaves.

-

As

stated in ISBP publication 681, paragraph 2 [now ISBP publication, 745

paragraph v] the applicant bears the risk of ambiguity in its instructions to

issue the credit or an amendment thereto....

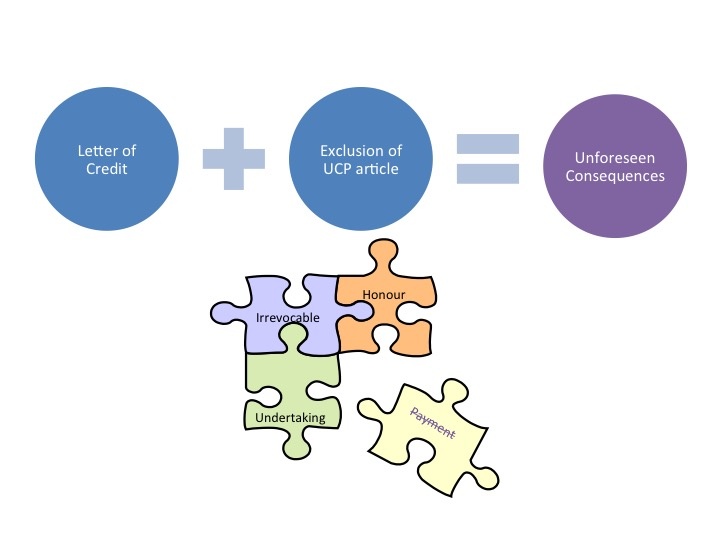

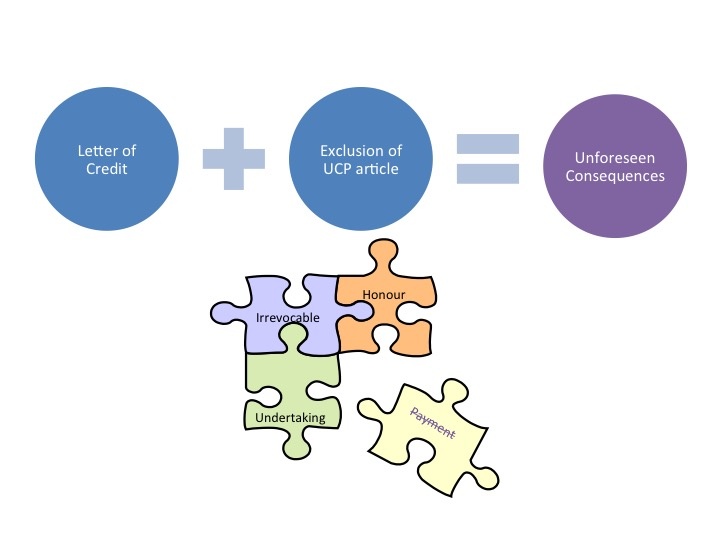

Fig. 1 - Potential impact of exclusions

A review of the main issues that have been raised to

us would indicate that the most common exclusions relate to the below UCP 600

sub-articles. However, this list is not all-inclusive.

-

7 (c) Issuing Bank Undertaking

-

10 (c) Amendments

-

10 (f) Amendments

-

12 (b) Nomination

-

14 (b) (e) (f) (i) (j) (k) (l) Standard for

Examination of Documents

-

16 (c) Discrepant Documents, Waiver and Notice

-

18 (a) (b) Commercial Invoice

-

20 (a) (c) (d) Bill of Lading

-

23 (c) Air Transport Document

-

27 Clean Transport Document

-

28 (i) Insurance Document and Coverage

-

35 Disclaimer (Lost Documents)

-

36 Force Majeure

-

37 (c) Disclaimer (Charges)

-

37 (d) Disclaimer (Foreign Laws)

-

38 (f) Transferable Credits

Banks (and traders) need to have in place a

recommended approach on how to deal with any exclusion ... or run the risk of a

transaction falling apart.

On a wider basis, it is critical to understand what

you are doing and why you are doing it. Ensure that you appreciate the

implications and consequences of excluding a UCP 600 article or sub-article

from a letter of credit.

We would suggest three approaches that would reduce

problems in this area:

-

Better understanding of letter of credit

workflows and the principles of UCP.

-

Wider awareness of ISBP 745 by all parties not

just banks (International Standard Banking Practice for the Examination of

Documents under UCP 600).

-

Distribution of information, i.e. ensuring that

ICC Opinions, DOCDEX Decisions and ICC Guidance Papers reach all participants

in the trade market.

The key is education - it should not be forgotten

that a letter of credit is in place to facilitate Trade and not to hinder it.

www.tradefinance.training