As mentioned in our previous blog, "exclusion of UCP 600 articles", the ICC 2015 Trade Survey reported that 34.4% of respondents encountered an increase in refusal rates of documents on first presentation.

In the 2014 survey, 31% of respondents reported an increase in the number of spurious discrepancies raised by issuing banks. A prior survey highlighted that only 7% of respondents reported a decrease in spurious discrepancies. It is clearly apparent that many banks (and, by extension, beneficiaries) are experiencing problems with ‘arguable' discrepancies.

In documentary credit operations, the advising of discrepancies in documents is probably the most contentious issue that a bank will face with its clients or another bank.

Global statistics differ but it is estimated that the percentage of documents refused on first presentation ranges between 60-75%. This does not necessarily mean that a beneficiary will not receive payment; but it does mean that, at the very least, there will be a delay in receiving settlement or financing and an increase in bank fees.

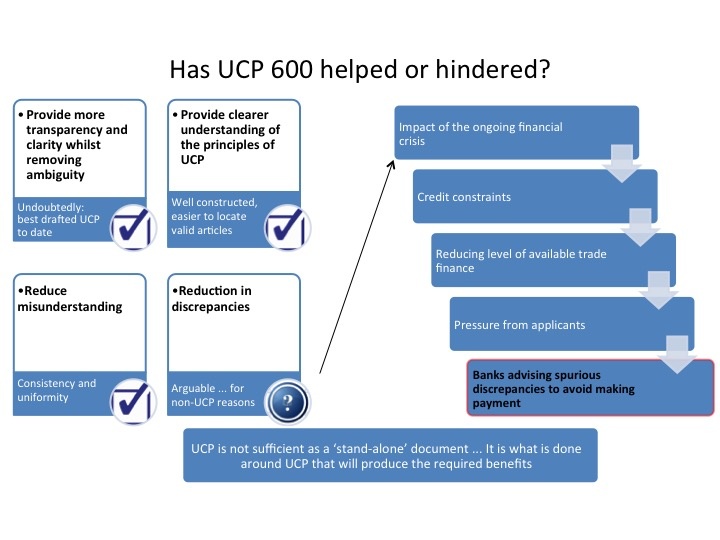

One perplexing issue is that the introduction of UCP 600 in 2007 does not appear to have improved the discrepancy rate. As figure 1 below shows, there is no doubt that UCP 600 has been invaluable to trade; however, as a stand-alone, it is not in a position to significantly reduce the discrepancy rate.

Fig. 1 UCP 600

Our experience is that the most common discrepancies fall within the following areas:

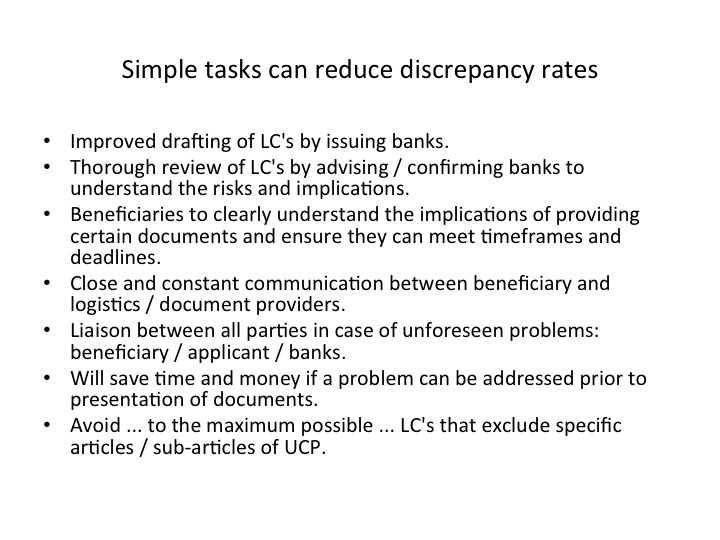

Comparison between these discrepancies and the guidelines that we provided in our "UCP 700" blog, as depicted in figure 2 below, demonstrates that many discrepancies can be avoided very easily.

Fig. 2 Simple tasks

We have made the observation in our ‘Discrepant Documents' training module (refer to Training Modules / Documentary Credits in Practice) that each bank has a duty to educate its clients. Where a client has been faced with discrepancies, a better presentation should occur next time if it is explained where the beneficiary went wrong. However, most banks merely advise discrepancies as if they were a fact of life.

Whether or not a bank refuses documents is based upon the content of the documents themselves, and their conformity to the documentary credit and UCP. At the end of the day, the decision to accept or reject is often down to an individual document examiner in assessing compliance or otherwise, based on his or her individual knowledge, experience and judgement. However, any discrepancy should stand one particular test - "would you feel comfortable in justifying that discrepancy before a judge in a court of law"? Remember, at the end of the day it would be a court that would be asked to make judgement if a dispute were not amicably resolved.

By the manner in which a bank expresses a discrepancy and explains it clearly to a beneficiary, it can demonstrate a quality approach that can set them apart from its peers.

Options available to a beneficiary when discrepancies are identified

If a presentation is refused due to discrepancies, there are three options available to secure payment under the LC. In order of suggested preference:

1) Correct the discrepancies, at least as far as is possible.

2) Request the nominated bank contact the issuing bank for its agreement that the documents may be honoured or negotiated despite the noted discrepancies. The documents will be held with the nominated bank until the issuing bank responds indicating that the applicant has provided an acceptable waiver of the discrepancies.

3) Request that the nominated bank forward the documents to the issuing bank for settlement. The documents are sent to the issuing bank as a presentation under the LC and honoured following the applicant issuing an acceptable waiver of the discrepancies.

Beneficiaries may find our ‘Document preparation' modules to be a significant aid in preparing documents under a documentary credit.